// TARGET: THE_MODERN_TREASURY_

In today’s hyper-competitive economic landscape, the role of the Chief Financial Officer has reached a critical inflection point. The mandate is no longer confined to managing liquidity, mitigating risk, and closing the books. Today, the CFO is the central strategic partner in enterprise growth, tasked with building a resilient, agile, and future-proof financial engine for the entire organization. This new, elevated mandate requires a new, non-negotiable form of literacy: digital asset mastery.

“The strategic imperative for today’s CFO is not to ‘invest in crypto.’ It is to understand and harness the underlying capabilities of on-chain finance to transform the corporate treasury from a legacy cost center into a dynamic, strategic asset.”

For years, digital assets have been perceived through a narrow and often misleading lens of speculative, high-risk investment. This perspective is not only outdated, it is strategically dangerous: to dismiss the underlying technology is to ignore one of the most significant shifts in financial infrastructure since the advent of the internet. A shift which fundamentally redefines data integrity, asset settlement, operational efficiency, and the very nature of corporate governance.

That’s why this understanding is no longer optional. It is a prerequisite for compliance, as new accounting standards (like ASU 2023-08) require firms to assess a digital asset’s core technology and governance before determining its accounting treatment. In this regard, true compliance begins with technological literacy.

Get the Definitive CFO’s Playbook

You’re reading the article. Now, get the entire 60-page framework it’s based on. This is the definitive guide to digital asset governance, compliance, and control.

- Learn the framework to Ensure Confident Compliance

- Get the templates to Architect Your Systems

- Turn your treasury from a cost center into a Strategic Asset

|

[ DOWNLOAD THE FRAMEWORK > ] |

The On-Chain Economic Genesis

At its core, the on-chain economy, built on Distributed Ledger Technology (DLT), offers an executive-level case study in operational integrity and risk reduction. These networks solve a critical business problem plaguing commerce for centuries: how to guarantee the state of a shared ledger and transfer value with absolute finality. Without relying on costly, slow, and often opaque intermediaries. This isn’t just a technical nuance, it is a governance breakthrough.

By synchronizing a shared database across a network, DLT creates a “single source of truth”. It is incredibly secure, transparent, and resistant to unauthorized alteration, thus enabling digital scarcity—the ability to create a unique, provably scarce digital asset. For the first time, a digital good can have the same assurance of uniqueness as a physical one.

For the modern CFO, these technological pillars translate into powerful, tangible business concepts:

- Provable Scarcity & Verifiable Ownership: Cryptography provides unambiguous, non-repudiable proof of who controls an asset. This establishes a new, higher standard for asset verification.

- Immutable History & Auditability: Every transaction is recorded on a permanent, auditable trail. This dramatically enhances transparency and simplifies reconciliation.

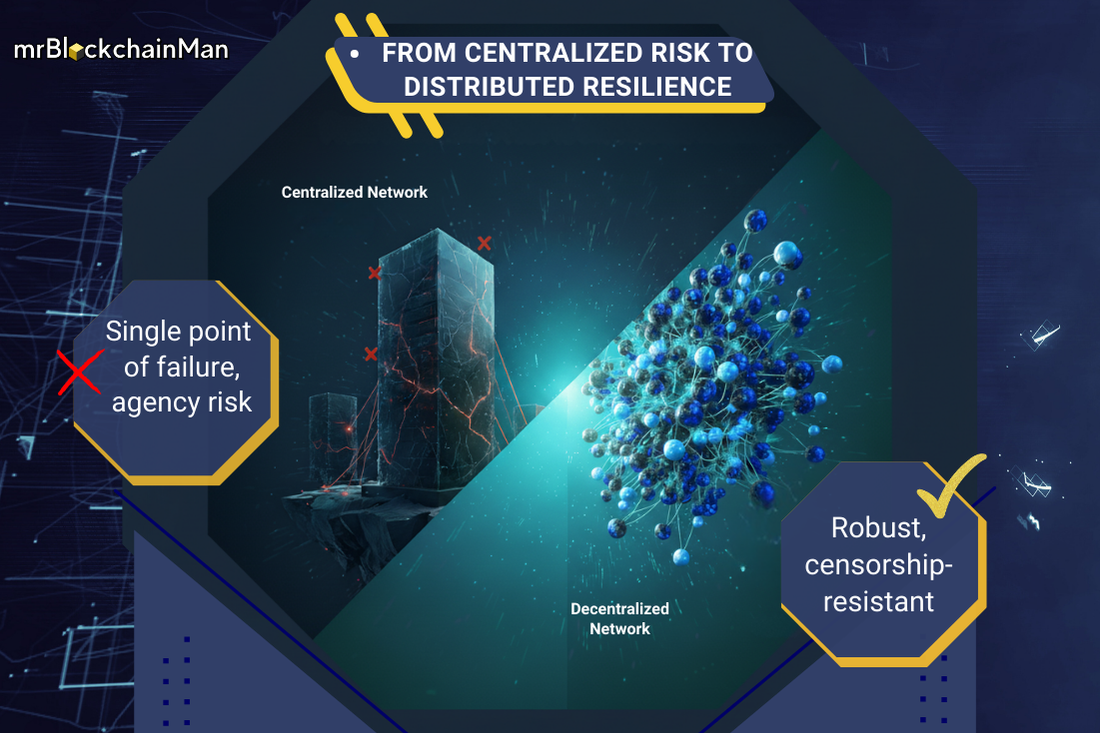

- Decentralized Governance: Unlike traditional systems with a single point of failure, these networks are maintained by a distributed community. Understanding the roles within this ecosystem is key to assessing an asset’s stability and long-term viability.

// FIGURE 1: MITIGATING CENTRALIZED RISK_

From Principles to Application: Building a Strategic Advantage

Once a firm can see through the confusion, it can begin to harness these foundational principles for tangible strategic benefit. Mastering digital assets in the modern treasury unlocks new levels of capital efficiency, mitigates operational risk, and gains a significant competitive advantage for the practitioner.

A treasury built on digital asset rails can achieve:

- Enhanced Capital Efficiency: Near-instant settlement frees up capital that would otherwise be locked in transactional limbo, allowing for more dynamic liquidity management and significantly faster, cheaper cross-border payments.

- Streamlined Operations & A Compliant Close: By leveraging a single, immutable source of truth, the need for laborious, multi-system reconciliation is drastically reduced. This paves the way for a more efficient, accurate, and auditable closing process.

- Ironclad Governance & Institutional Control: This is the CFO’s primary domain in the digital asset age. Mastery is impossible without establishing institutional-grade internal controls. It demands a robust Wallet Management System (WMS), a formal Corporate Custody Program, and rigorous, documented access controls.

- New Strategic Capabilities: The application of this technology extends far beyond simple payments. It enables innovations in supply chain management through enhanced traceability, access to new capital pools via decentralized finance (DeFi) protocols, and new models for customer engagement through tokenization.

Firms that build this capability now will not only optimize their balance sheets but also signal to the market that they operate at a higher standard of efficiency and security.

“The greatest risks in this space are not technological; they are failures of human process. Ironclad governance is the bedrock of a strategic digital asset treasury.”

From Reactive Management to Proactive Mastery

The transition to a digital asset treasury (DAT) is not a technological project, it is a strategic evolution. It requires more than just new software: it demands a new level of team-wide education and a comprehensive framework for governance, compliance, and control.

// KEY TAKEAWAYS_

- Education: Building team-wide literacy on core technologies.

- Governance: Implementing robust human processes and controls.

- Strategy: Leveraging the technology for competitive advantage, not just management.

Achieving this outcome moves an organization beyond simply managing a new asset class to achieving true mastery. This means transforming the finance function from a reactive scorekeeper into a proactive strategic advisor, capable of leveraging these new tools to identify opportunities, mitigate emerging risks, and drive enterprise value. The result is an institution that is more resilient, more efficient, and better positioned to capitalize on the economic opportunities of the coming decade.

The Only “Front-to-Back” Ecosystem

Understanding the strategic “why” is the first step. Mastering the operational “how” is the next.

While traditional firms offer high-level theory and standard crypto courses offer low-level retail tactics, mrBlockchainMan delivers the complete operating system. We are the only partner that combines Executive Governance (Strategy), Technical Simulation (Ops), and Compliant Reporting (Audit) into a single, certified mastery path.

Don’t just learn crypto. Certify your team in the Standard.

|

[ SECURE THE FOUNDER’S BUNDLE > ] |