The On-Chain Conundrum

The digital asset landscape presents a strategic paradox for today’s CFO. On one hand, it offers unprecedented opportunities to enhance treasury functions, streamline operations, and create a competitive advantage. On the other, it’s a bewildering ecosystem of thousands of assets, each with its own complex jargon and opaque value proposition.

This diversity complicates everything from strategic investment to ensuring meticulous compliance. Your team is focused on core business operations, not deciphering the viability of every new protocol. The critical question isn’t just “Why are there so many?” but “How do we confidently discern strategic assets from speculative noise?”

This article cuts through the confusion. We’ll introduce the foundational framework we use to analyze any digital asset, providing the clarity you need to lead your organization with confidence.

Get the Definitive CFO’s Playbook

You’re reading the article. Now, get the entire 60-page framework it’s based on. This is the definitive guide to digital asset governance, compliance, and control.

- Learn the framework to Ensure Confident Compliance

- Get the templates to Architect Your Systems

- Turn your treasury from a cost center into a Strategic Asset

The Underlying Structure: Introducing the Crypto Triplicity

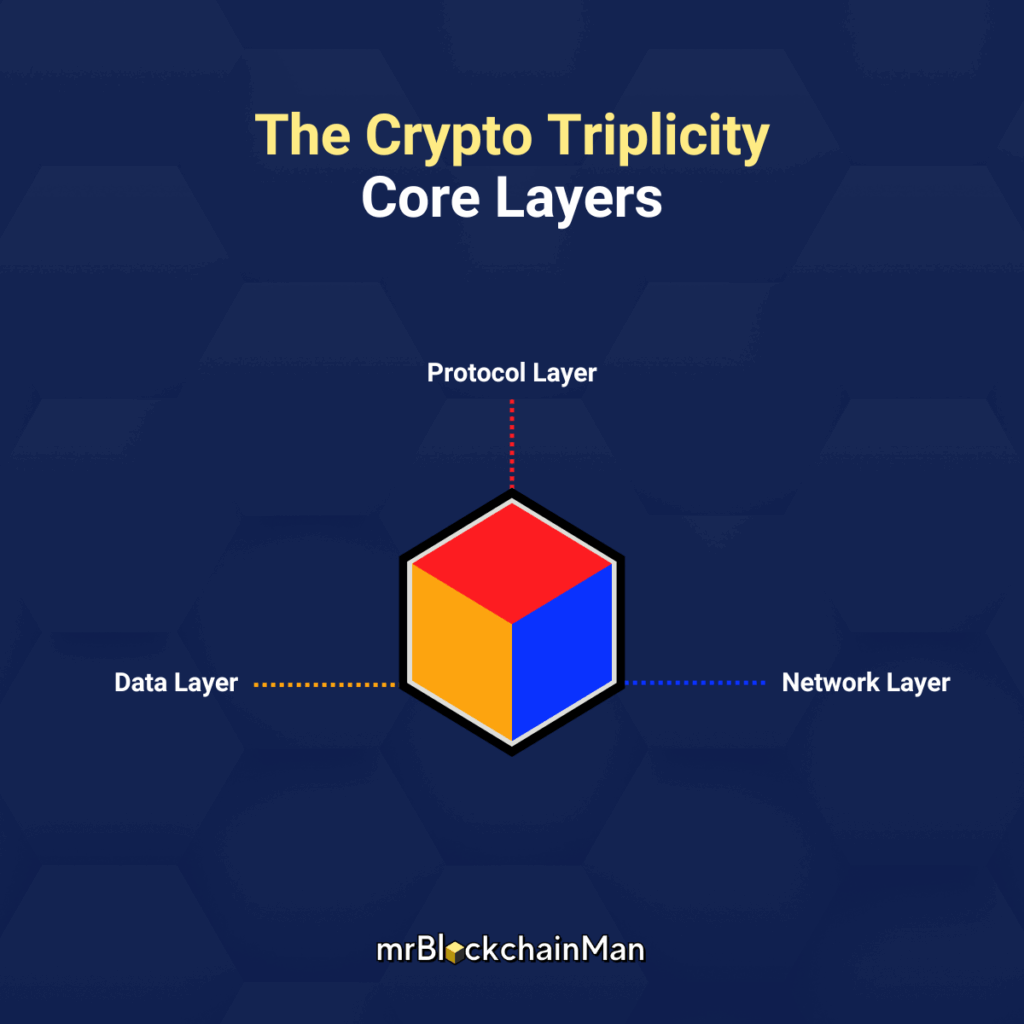

Beneath the digital asset chaos, a powerful structure governs them all: the Crypto Triplicity. This foundational framework reveals the crucial roles which people, organizations, and technology play in shaping a crypto’s functionality and value. At its core, every cryptographic asset operates on three distinct, yet deeply interconnected, core layers: Data, Protocol, and Network. For a CFO, understanding these layers is key to assessing risk and opportunity.

- Data Layer (The System of Record): Think of this as the system’s immutable ledger. It permanently stores all transaction history, ensuring the integrity and auditability of the asset. This is the foundation of trust.

- Protocol Layer (The Governing Policy): This is the asset’s ‘constitution’ or rulebook. It defines the core policies for transaction validation, asset creation (scarcity), and governance. This layer dictates the asset’s fundamental risk profile and mechanisms.

- Network Layer (The Operational Infrastructure): This is the infrastructure that connects users and enables transactions. Its design directly impacts performance, transaction speed, and cost—critical factors for any business application.

These three layers are not isolated; they are profoundly interdependent. Attributes or limitations within any single layer directly impact the performance and characteristics of the others, creating a dynamic system where collective strengths and weaknesses are constantly in play. Grasping this interplay is paramount to understanding how to align digital assets with your firm’s strategy.

Why So Many Assets? The Impact of Strategic Design

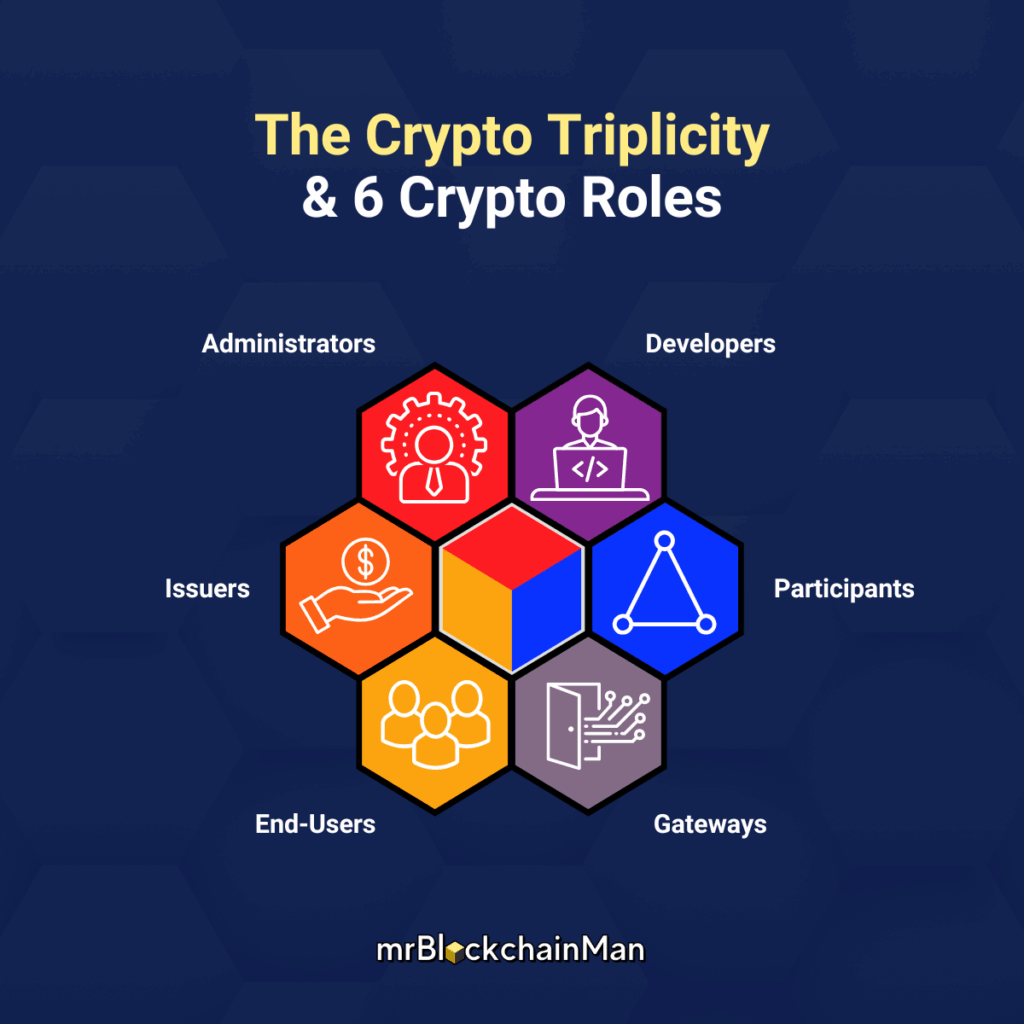

The thousands of digital assets in existence are a direct result of the countless strategic design choices made within each of these three layers. Founders and developers tailor each layer to solve a specific problem or serve a particular market, creating assets with unique operational design.

This is where the six key roles, from Issuers and Developers to Administrators and Participants, make their impact. Their decisions on governance models, security protocols, and economic incentives are why one asset is optimized for rapid, low-cost payments while another is designed for secure, high-value settlement. The diversity isn’t chaos; it’s purposeful architectural design.

From Complexity to Clarity: Our Analytical Edge

Understanding the “why” is the first step. But as a CFO, you need a systematic way to assess an asset’s potential and its fit for your firm’s treasury. This is the precise challenge our proprietary framework, theCLoC, was built to solve.

theCLoC (the Colorful Links of Crypto) is the compass we use to navigate the crypto landscape for our clients. It builds upon the Crypto Triplicity, translating the abstract interplay of layers and roles into a clear, actionable analysis. It allows us to systematically evaluate an asset’s capabilities, risk factors, and strategic value, transforming overwhelming data into the clear intelligence you need to make sound financial decisions.

Your Path to Digital Asset Mastery

Discerning value in the digital asset market isn’t about tracking thousands of assets—it’s about having a robust framework to analyze the few that matter to your business. The Crypto Triplicity provides this foundational understanding.

For CFOs ready to move from analysis to action, we apply our proprietary theCLoC framework to help you build a modern, resilient, and strategic treasury.

Ready to transform your digital asset management from a challenge into a competitive advantage?

Schedule a confidential Clarity Consult with our founder today to discuss your specific goals.